What is Grameen Bank?

Bank For Poor (Grameen Bank)

source: Wikipedia

part:3

Grameen Bank

Operational statistics

|

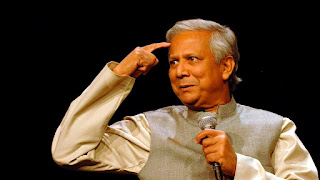

| Nobel Laureate Muhammad Yunus, the bank's founder |

Grameen Bank is owned by the borrowers of the bank, most of whom are poor girls. Of the overall equity of the bank, the borrowers own ninety four, and also the remaining sixth is owned by the Asian nation government.

The bank grew considerably between 2003 and 2007. As of Jan 2011, the overall borrowers of the bank range eight.4 million, and ninety seven of these are girls. the amount of borrowers has quite doubled since 2003, once the bank had three.12 million members. Similar growth are often discovered within the range of villages coated. As of Oct 2007, the Bank features a employees of quite twenty four,703 employees; its two,468 branches offer services to eighty,257 villages, up from the forty three,681 villages coated in 2003.

The bank has distributed BDT one.437 trillion (US$20.92 billion) in loans, out of that BDT one.317 trillion (US$19.02 billion) has been repaid. The bank claims a loan recovery rate of ninety six.67%, up from the ninety five recovery rate claimed in 1998. David Roodman has critiqued the accounting practices that Grameen accustomed verify this rate.

The global range of potential micro-borrowers is calculable to be one billion, with a complete loan demand of $250 billion. the current microfinance model is serving one hundred million folks with $25 billion of loans. The Grameen Bank is ninety five owned by the native poor and fifth by the govt.

Staff coaching

The Grameen Bank employees typically add tough conditions. staff receive half dozen months of on-the-job coaching whereas shadowing qualified and toughened people from numerous branches of Grameen. The goal of this coaching is for the novice to "appreciate the undiscovered potential of the destitute" and to find new ways in which to resolve issues that arise among the Grameen branch. once finishing the 6-month amount, trainees come back to capital of Bangladesh headquarters for review and critique before appointment to a bank branch.

Honours

• 1994, Grameen Bank received the legal holiday Award in 1994, that is that the highest government award.

• thirteen Oct 2006, the Nobel Committee awarded Grameen Bank and its founder, Muhammad Yunus, the 2006 Nobel Peace Prize "for their efforts to make economic and social development from below." The award announcement additionally mentions that:

From modest beginnings 3 decades past, Yunus has, 1st and foremost through Grameen Bank, developed micro-credit into Associate in Nursing ever additional necessary instrument within the struggle against poorness. Grameen Bank has been a supply of concepts and models for the various establishments within the field of micro-credit that have sprung up round the world.

On ten Gregorian calendar month 2006, Mosammat Taslima Muhammadan, United Nations agency used her 1st 16-euro (20-dollar) loan from the bank in 1992 to shop for a goat and later became a flourishing bourgeois and one in all the electoral board members of the bank, accepted the award on behalf of Grameen Bank's investors and borrowers at the prize grant ceremony command at capital of Norway hall.

Grameen Bank is that the solely business corporation to possess won a award. academician Ole Danbolt Mjøs, Chairman of the Norwegian Nobel Committee, in his speech aforementioned that, by giving the prize to Grameen Bank and Muhammad Yunus, the Norwegian Nobel Committee needed to encourage attention on achievements of the Muslim world, on the women's perspective, and on the fight against poorness.

Citizens of Asian nation celebrated the prize. Some critics aforementioned that the award affirms liberalism.

Related ventures

Main article: Grameen family of organizations

The Grameen Bank has big into over 24 enterprises of the Grameen Family of Enterprises. These organisations embody Grameen Trust, Grameen Fund, Grameen Communications, Grameen Shakti (Grameen Energy), Grameen medium, Grameen Shikkha (Grameen Education), Grameen Motsho (Grameen Fisheries), Grameen Baybosa Bikash (Grameen Business Development), Grameen Phone, Grameen computer code restricted, Grameen CyberNet restricted, Grameen wear restricted, and Grameen Uddog (owner of the complete Grameen Check).

On eleven July 2005 the Grameen open-end fund One (GMFO), approved by the Securities and Exchange Commission of Asian nation, was listed as Associate in Nursing Initial Public giving. one in all the primary mutual funds of its kind, GMFO can permit the quite four million Grameen bank members, also as non-members, to shop for into Bangladesh's capital markets. The Bank and its constituents are along price over US$7.4 billion

|

| Nobel Laureate Muhammad Yunus, the bank's founder |

The Grameen Foundation was developed to share the Grameen philosophy and expand the advantages of microfinance for the world's poorest folks. Grameen Foundation, that has Associate in Nursing A-rating from [Charity Watch], provides microloans within the USA (the solely developed country wherever this is often done), and supports microfinance establishments worldwide with loan guarantees, training, and technology transfer. As of 2008, Grameen Foundation supports microfinance establishments within the following regions:

• Asia-Pacific: Asian nation, China, East Timor, Indonesia, India, Lebanon, Pakistan, Philippines, Saudi Arabia, Yemen

• Americas: Bolivia, state, Central American country, Haiti, Honduras, Mexico, Peru, US

• Africa: Cameroon, Egypt, Ethiopia, Ghana, Morocco, Nigeria, Rwanda, Tunisia, Uganda

Criticism

Some analysts have steered that microcredit will bring communities into debt from that they can not escape. Researchers have noted instances once microloans from the Grameen Bank were joined to exploitation and pressures on poor families to sell their belongings, leading in extreme cases to humiliation and ultimately suicides.

The Mises Institute's Jeffrey Tucker suggests that microcredit banks rely on subsidies to work, so acting as another example of welfare. Yunus believes that he's operating against the supported economy, giving borrowers the chance to make businesses. a number of Tucker's criticism relies on his interpretation of Grameen's "16 choices," seen as instruction, while not considering what they mean within the context of poor, illiterate peasants.

Maulana Ibrahim, Associate in Nursing Muhammedan in Asian nation, spoke out against the Grameen Bank in 1993 for fostering "un-Islamic ways in which." He alleged that the lenders' pledge needed girls to mention they might not conform their husbands and wouldn't board poorness any longer.

The Norwegian documentary, Caught in small debt, aforementioned that Grameen evaded taxes. The Spanish documentary, Microcredit, additionally steered this. The accusation relies on the unauthorised transfer of roughly US$100 million, given by The Norwegian Agency for Development Cooperation (NORAD), from one Grameen entity to a different in 1996, before the expiration of the Grameen Bank's tax exemption. However, NORAD printed a press release in Gregorian calendar month 2010 clearing Yunus and also the Bank of any wrongdoing on now, following a comprehensive review of NORAD's support commissioned by the Minister of International Development.

Yunus denies that this is often tax evasion:

There is absolute confidence of evasion here. the govt has provided organisations with opportunities; we've created use of those opportunities with aim of benefitting our shareholders United Nations agency are the agricultural poor girls of Asian nation.

David Roodman and eating apple Morduch question the applied mathematics validity of studies of microcredit's effects on poorness, noting the complexness of the things concerned. Yoolim Lee and Ruth David discuss however microfinance and also the Grameen model in South Asian nation have in recent years been distorted by venture free enterprise and profit-makers. In some cases, poor rural families have suffered debt spirals, harassment by microfinance debt collectors, and in some cases suicide.

No comments:

Post a Comment